Our Industry Remains Resilient – and Growing

Between economic uncertainty, recession rumors, and the threat of climate change, the world's going through some major terrifying changes. Do you know what’s still going amazingly well? The insurance sector. It's soaring sky-high with record-breaking growth in 2023!

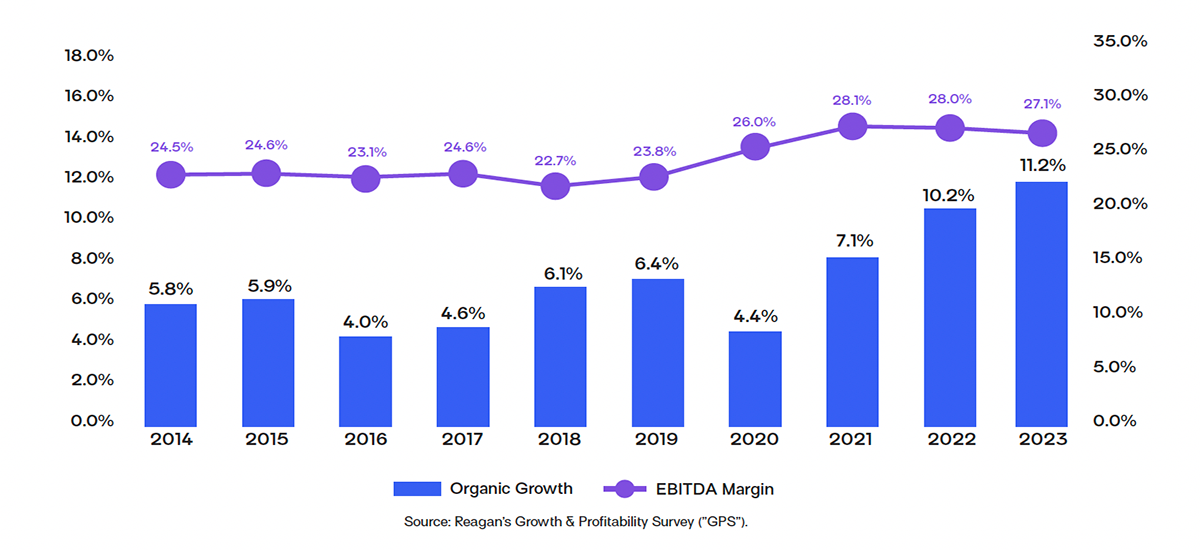

In fact, according to Reagan Consulting, organic industry growth reached an all-time high of 11.2% in the second quarter of 20231. A big part of this was commercial lines, with impressive organic growth of 11.7%, the highest Q2 results in Reagan’s survey history. Not far behind was personal lines, which saw record-breaking growth of 10.6% for the same period.

Incredible growth does come with some problems. One of the challenges is that the insurance field has a very – like, very – low unemployment rate of 1.4% 2. In a historically tight labor market, providing your scarce talent with the right technology and tools is more important than ever. As we work together to attract a new generation to the insurance industry, we need to stay focused on empowering the current generation of insurance professionals; we can do this by providing the technology they need to win in the Digital Growth Era of Insurance.

Making Your Agency More Valuable

At EZLynx®, we’re committed to creating solutions that drive higher-than-average revenue growth at a lower-than-average cost to make your agency more valuable. We use this simple framework to guide our investment decisions.

Shortening the Digital Roundtrip of Insurance Makes You More Competitive

One of the most powerful ways to fulfill our mission of helping you grow is by scaling our insurance technology to connect the Digital Roundtrip of Insurance. Basically, we’re set on giving you the tech you need to execute and link every part of the insurance journey – from connecting with customers to selling your services to growing your agency and beyond.

As we’ve continued to focus on connecting each aspect of the Digital Roundtrip of Insurance, we’ve realized that the greatest value comes from accelerating the full roundtrip (quoting, selling, renewing and communicating with clients) for your personal lines and small commercial lines business. Doing so helps you get more done, prioritize the most valuable tasks, deliver more to your clients in less time, and grow your agency faster overall.

Take a look at our eBook Up Your Insurance Game in the Digital Growth Era to learn how to accelerate the Digital Roundtrip of Insurance so your business can step into the Digital Growth Era with the latest technology by your side.